Digital Finance Online Banking System

Online Banking System

Online Banking Provides a Full Range of Financial Services.

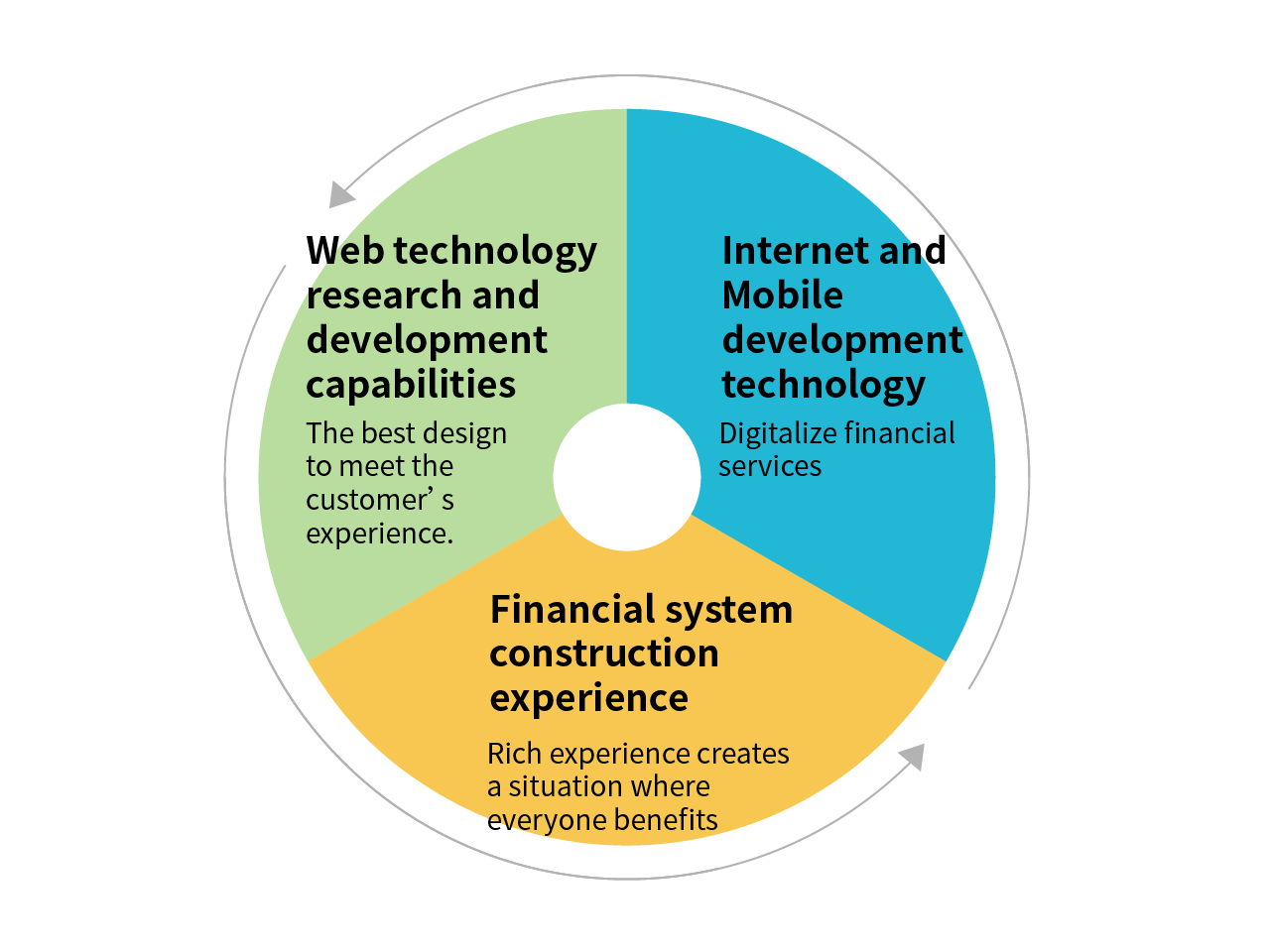

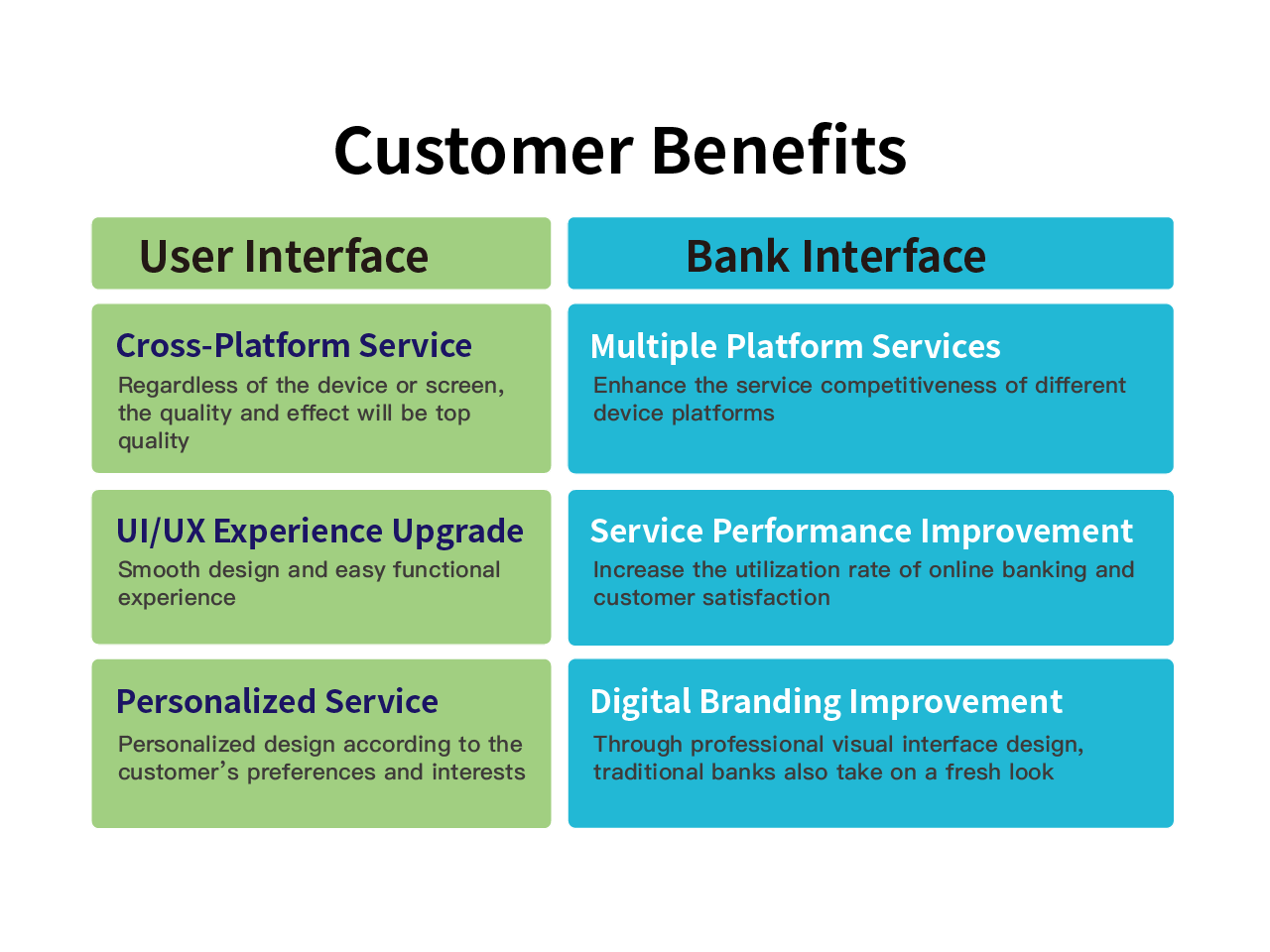

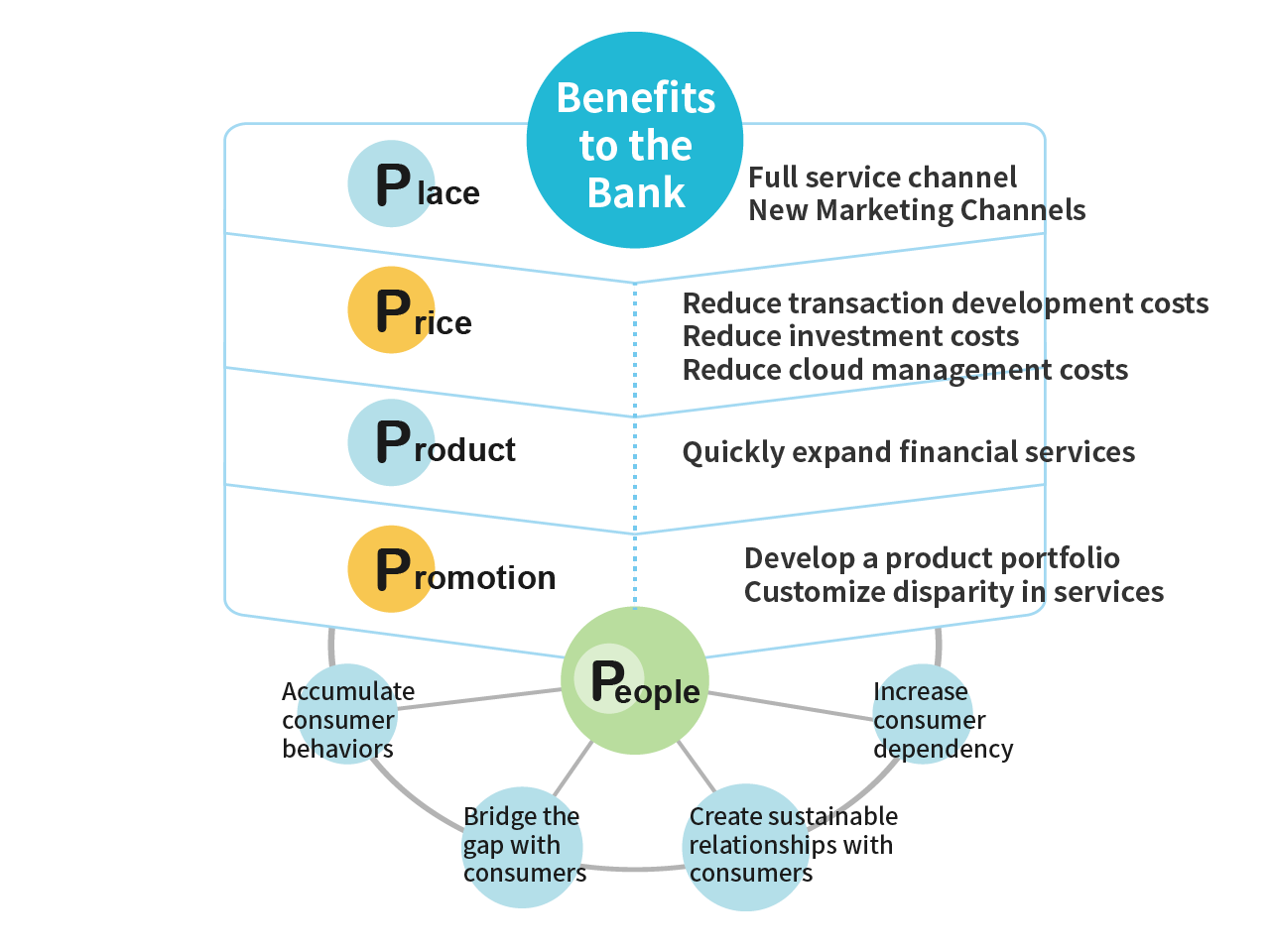

With the vast improvements to the social network infrastructure and major steps forward in information transmission, people emphasize efficiency and convenience, especially with the rapid changes of financial products and services. Customers want instant gratification and with regards to their finances, regardless of where they are. The public's acceptance and utilization rate of online banking or using financial services through smart devices has increased significantly; the physical channels that banks relied on in the past such as branches and ATMs are no longer the primary choice for customers to contact banks. Online banking, mobile banking and other financial services are the norm. The overall transaction volume and transaction value of the digital service channels have rapidly increased. The digital channels of financial services need to provide a more user-friendly interface, give the public a high-quality user experience, and meet the needs of the Internet community for more diverse mobile devices.

Online banking represents the entrance to consumer financial services and digital financial services. It is also the most important channel for customers to access digital services on the Internet. Designing a digital brand identity, building a stable and flexible expansion, and provide an online banking website system, which supports a friendly and user-friendly interface for mobile devices. These are the focal points of how banks are planning a new generation of online banking.